For many home buyers, navigating the complexities of home loan deposits, property prices and lender rules can be confusing and time consuming.

That’s why the team at Bluestone Home Loans has put together the Ultimate Borrower’s Guide to LVR to help you understand what it means and avoid any costly mistakes.

Whether you’re navigating a competitive property market or aiming to get your foot in the door with a smaller deposit, having a solid grasp of LVR can ensure you secure the right mortgage and take a confident first step toward homeownership.

First things first, what is Loan to Value Ratio (LVR)?

Loan to Value Ratio – also referred to as LVR – is an important measurement used by lenders when assessing your mortgage application.

It represents the amount of the property’s value that you’re borrowing, expressed as a percentage.

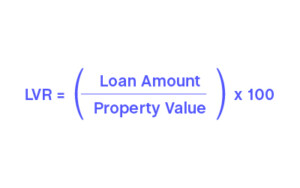

The LVR is calculated by dividing the loan amount by the estimated value of the property, then multiplying by 100.

For example, let’s say you’re looking to purchase a property valued at $500,000 and you need a $400,000 loan. Your LVR would be 80% ($400,000 ÷ $500,000 x 100 = 80%).

Why is LVR important?

Understanding LVR is important for anyone planning to buy a property, as it directly impacts your borrowing capacity, potential interest rates, and the loan options available to you.

Lender risk

LVR gives lenders an idea of how much risk they’re taking on by lending to you. A higher LVR means a higher risk for the lender because there’s less equity in the property. As a result, higher LVR loans may come with stricter requirements or higher interest rates.

Borrowing capacity

LVR can influence how much you can borrow. Many lenders offer better rates for lower LVRs, especially those below 80%. If your LVR is above 80%, you may need to pay for Lenders Mortgage Insurance (LMI) or secure other arrangements to reduce the risk for the lender. Bluestone however, does not charge LMI.

Interest rates

In general, the lower your LVR is the more competitive and favourable your interest rates will be. On the other hand, if you’re borrowing at a higher LVR, you may end up with higher rates as the lender compensates for the increased risk.

Understanding your LVR by talking with a broker before applying for a loan can help you better navigate the mortgage market and make smarter financial decisions.

How to calculate your LVR

Calculating your LVR is straightforward and only requires two key pieces of information: the loan amount and the property’s appraised or estimated value. Here’s the formula:

Let’s say you’re purchasing a property worth $600,000, and you’re applying for a loan of $480,000. To calculate your LVR simply do the following:

Loan amount: $480,000

Property value: $600,000

LVR = (480,000 ÷ 600,000) x 100 = 80%

If you’d like a fast way to calculate your LVR, you can use our LVR Calculator HERE

3 examples of different LVR mortgages

Loan to Value Ratio thresholds can vary based on your financial situation, specific lender policies, and market conditions. Here’s a breakdown of some common LVR scenarios:

80% LVR – Standard Home Loan

This is a common threshold where borrowers typically get more favourable loan conditions. At 80% LVR, you’re borrowing 80% of the property value and have a 20% deposit. Lenders can perceive a lender with 20% saved deposit as lower risk, which often negates the need for LMI.

Scenario: You’re purchasing a $950,000 home with a $760,000 loan (80% LVR), so you would need a $190,000 deposit.

90% LVR – Low Deposit Loan

If you’ve only saved a 10% deposit, you’ll need a 90% LVR loan. This allows you to borrow a higher percentage of the property values, but your lender may charge LMI due to the higher risk. The upside is that you may get into the property market sooner without needing to save a full 20% deposit.

Scenario: You’re purchasing a $500,000 apartment with a $450,000 loan (90% LVR), so you would need a $50,000 deposit.

95% LVR – High LVR Loan

A 95% LVR is for those with a minimal deposit—just 5%. Lenders typically consider this high risk, which means LMI is likely required, and interest rates can be higher – especially with the big banks. However, this can be a viable option for first-time buyers looking to enter the market with a low deposit.

Scenario: You’re purchasing a $600,000 property with a $570,000 loan (95% LVR), so you would need a $30,000 deposit.

LVR Snapshot: Three things to remember

Lower LVR, better rates: If possible, aim for an LVR of 80% or lower to secure more favourable interest rates and avoid Lenders Mortgage Insurance (LMI).

Higher LVR, higher risk: A higher LVR (90%) may mean more risk for lenders, which could lead to higher rates and additional costs like LMI for loans above 80% LVR.

LVR impacts borrowing power: Knowing your LVR will help you understand how much you can borrow and whether your deposit is enough for your dream property.

Bluestone’s flexible LVR Options

At Bluestone Home Loans, we offer flexible, easy-to-understand mortgage options that cater to a range of LVRs, helping more people achieve their property dreams sooner.

Up to 90% LVR without LMI

Yes, it’s possible! One of our standout features is the ability to borrow up to 90% LVR without the need for Lenders Mortgage Insurance on some products. This is available on some of our home loan products, including Owner Occupier and Residential Investment home loans.

Low deposit options

Don’t have a 20% deposit? No problem. We accept as low as 10% deposit, so you can still move forward with your property plans. Whether you’re a first-time buyer or an experienced investor, our flexible options allow you to find a solution that works for your unique situation.

Self-employed or credit issues?

At Bluestone, we know that every borrower is different. Many people have complicated financial backgrounds, are sole traders or self-employed or have recently become a citizen of Australia. We’re here to help you access a suitable home loan even if your circumstances are complex or you have a less-than-perfect credit history.

Fast, flexible, simple

With Bluestone, you won’t be waiting weeks for approval. We’ll be on hand to answer any questions you have regarding LVR, home loan deposits or your potential borrowing power. By knowing all of this, you can make smarter decisions and avoid unnecessary costs. We can help you cut through the complexity, keep it simple and save time.

Talk with a Bluestone broker today

If you want to better understand your financial situation and experience the Bluestone difference, contact our team today.